In a bold move to reshape the American economy, former President Donald Trump has proposed a new tax plan that eliminates taxes on tips, overtime pay, and Social Security benefits. This initiative aims to provide financial relief to workers and encourage higher earnings for those in service industries, where tips constitute a significant portion of income. By removing the tax burden associated with overtime, Trump believes that employees will be incentivized to work more hours, thus increasing their take-home pay. Additionally, exempting Social Security from taxation could enhance the financial security of retirees and those with disabilities, allowing them to retain more of their earnings. This comprehensive plan is designed to stimulate economic growth and empower the American workforce, ultimately fostering a more robust economy. As Trump rallies support for this proposal, it raises important discussions about tax reform and its potential impacts on various sectors of society. The plan underscores his commitment to prioritizing the needs of everyday Americans, making it a pivotal aspect of his vision for the country’s future.

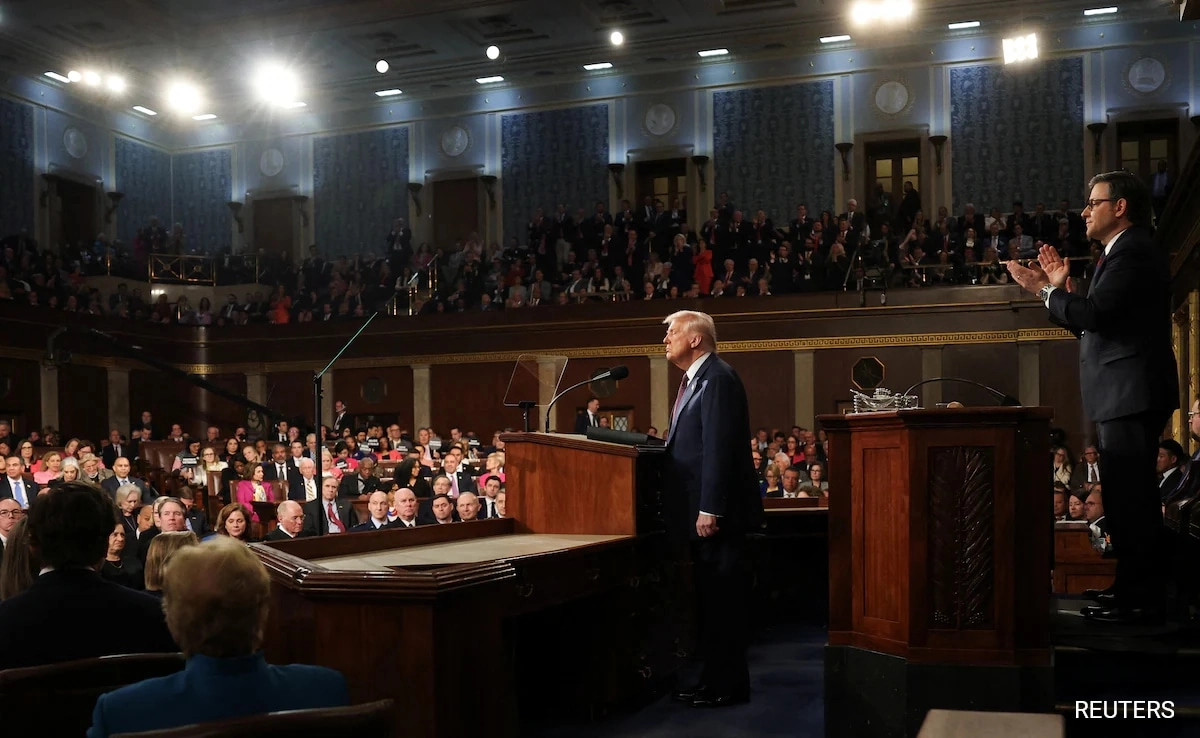

In a bold move to reshape the American economy, former President Donald Trump has proposed a new tax plan that eliminates taxes on tips, overtime pay, and Social Security benefits