The question arises whether silver will also become a rare earth element. This topic has sparked curiosity and surprise around the world, particularly after certain developments involving China, often referred to as “the Dragon.” The implications of such a transformation could be profound, affecting markets and industries that rely on silver for various applications, including electronics, jewelry, and even renewable energy technologies.

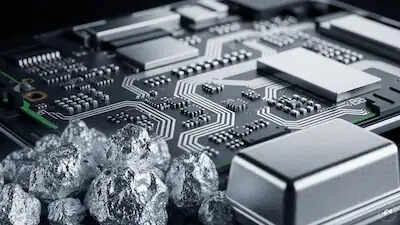

Recent reports suggest that China has taken significant steps toward controlling the supply chain of silver, similar to its strategies with other critical minerals. This has raised alarms among global investors and manufacturers who depend on silver. If silver were to be classified as a rare earth element, it could lead to increased prices and heightened competition for access to this precious metal. The potential scarcity could drive innovation in the search for alternatives or substitutes, as industries would need to adapt to a new reality where silver is not as readily available.

Moreover, the global implications of this shift cannot be understated. Countries that are rich in silver reserves could find themselves in a position of greater economic power, while those that rely on imports may face challenges in securing this vital resource. As nations scramble to secure their supply lines, geopolitical tensions could rise, reminiscent of the race for other rare earth materials in recent years. In this context, the role of silver in the global economy could be redefined, making it a focal point of international trade discussions and strategies.

In conclusion, the world is watching closely as developments unfold regarding silver’s status and its potential transformation into a rare earth element. The actions of key players, particularly China, could reshape markets and influence global economic dynamics. As industries adapt to these changes, the future of silver may hold surprises that could impact everything from technology to investment strategies.