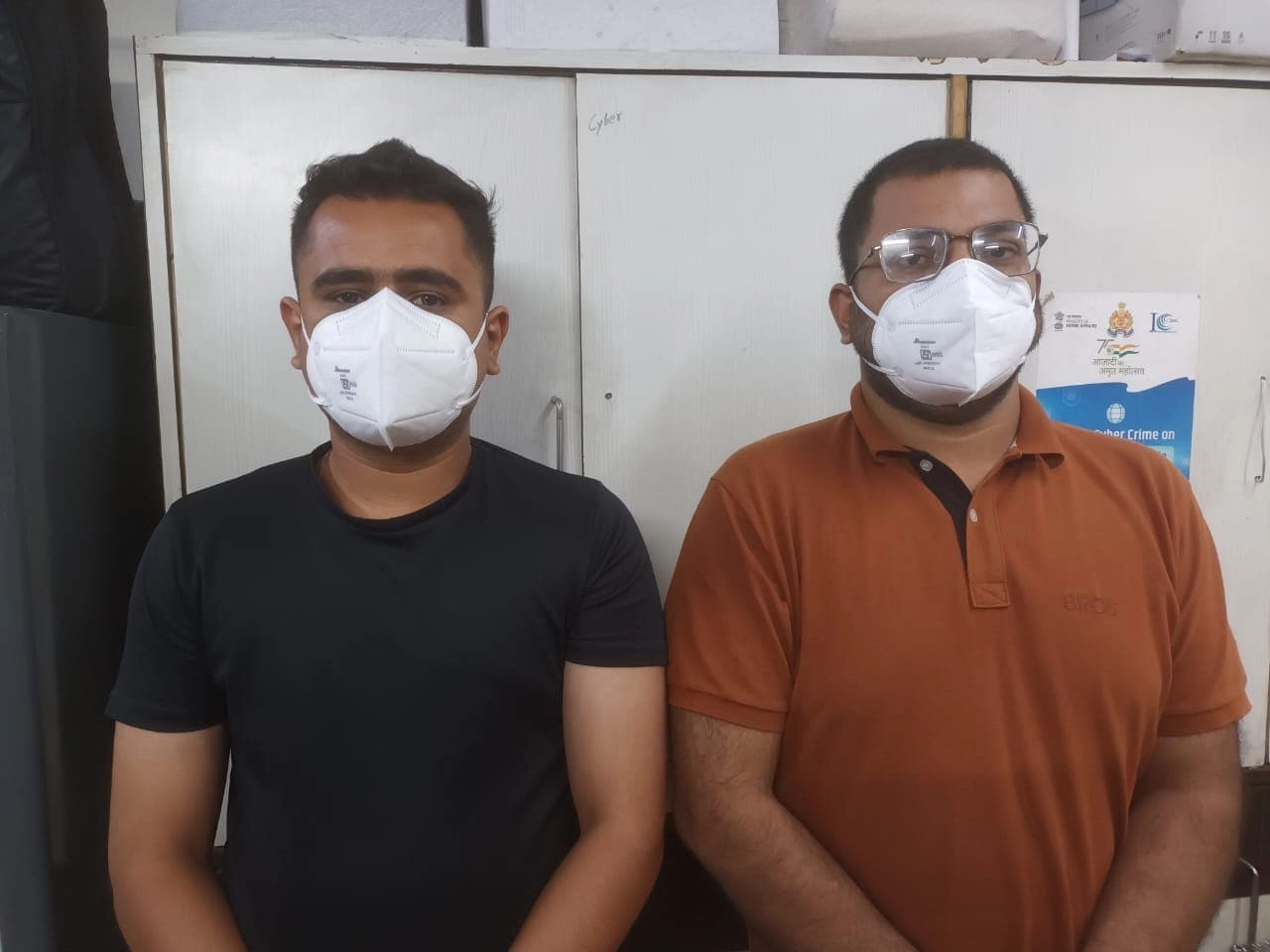

In a significant development that underscores the importance of financial security and corporate integrity, two employees of Paytm have been arrested for allegedly facilitating the release of Rs 30 lakh from frozen accounts. This incident has raised serious concerns about the internal controls and ethical standards within one of India’s leading digital payment platforms. The employees were reportedly involved in a scheme that aimed to manipulate the company’s account management system, enabling them to access funds that were previously frozen due to regulatory issues or suspicious activities.

The frozen accounts were under scrutiny as part of routine checks aimed at preventing fraud and ensuring compliance with financial regulations. However, the actions of these employees not only jeopardized the integrity of the financial system but also posed a risk to the trust that customers and investors place in digital payment platforms. The arrest of the two individuals serves as a stark reminder of the challenges faced by companies in maintaining robust security measures in an increasingly digital world.

Authorities have launched a broader investigation to determine the extent of the malpractice and whether other employees were involved in this illicit activity. This incident highlights the need for companies like Paytm to reinforce their internal controls and conduct regular audits to prevent such occurrences in the future. Furthermore, it raises questions about employee training and awareness regarding ethical practices and legal compliance in financial transactions.

As the digital finance sector continues to expand rapidly in India, incidents like this could undermine consumer confidence and hinder the growth of fintech companies. Stakeholders will be closely monitoring the outcomes of this case, as it may lead to stricter regulations and oversight in the industry. The case serves as a crucial lesson for other companies, emphasizing the importance of vigilance and integrity in their operations to safeguard both their reputation and the financial ecosystem at large.