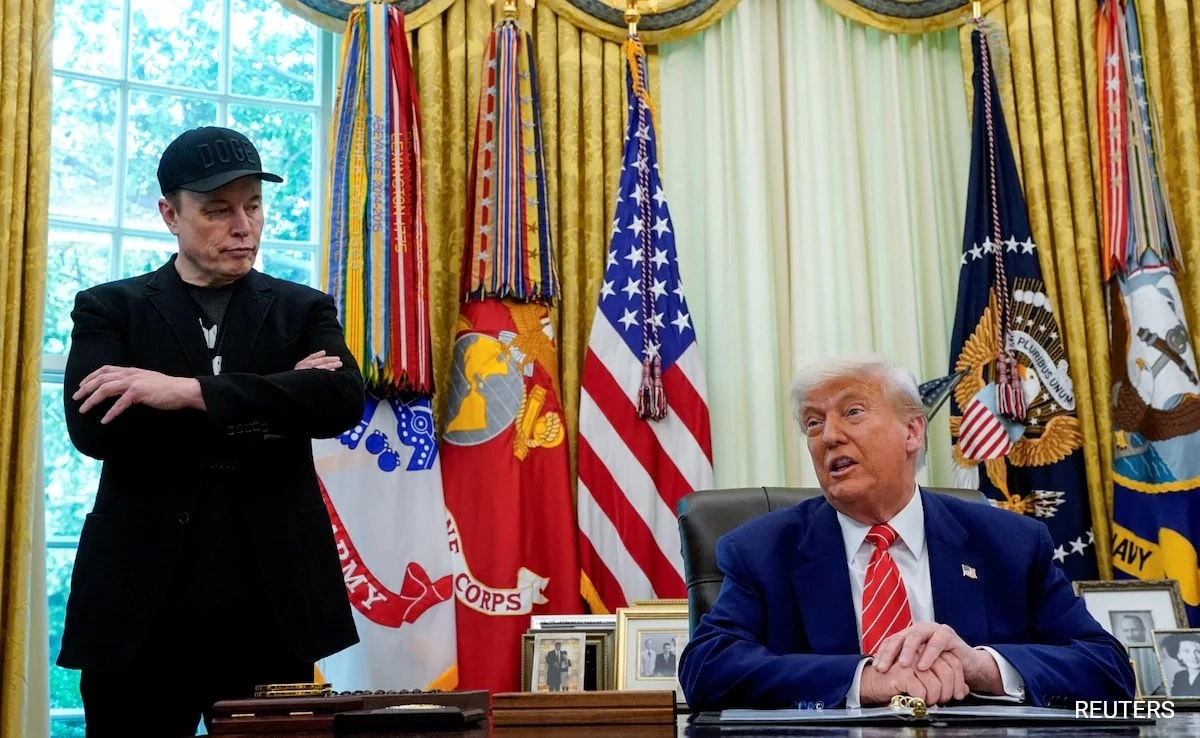

U.S. stock markets experienced a notable decline as investors reacted to a variety of economic indicators and corporate developments, with Tesla’s stock taking a significant hit amid the ongoing controversy involving CEO Elon Musk and former President Donald Trump. Market analysts observed that the broader decline in equities followed a period of record highs, signaling a potential shift in investor sentiment. The connection between Tesla’s performance and the political discourse surrounding Musk has drawn attention, especially as the billionaire’s controversial statements have led to increased scrutiny from both the public and investors.

Tesla’s stock fell sharply as concerns grew over the implications of Musk’s recent comments and actions related to Trump. This situation not only affected Tesla but also contributed to a broader market sell-off, as investors grappled with uncertainty. The intertwining of corporate performance with the political landscape has become more pronounced, highlighting how individual companies can be impacted by the behaviors and statements of their leaders. Analysts suggest that this phenomenon reflects a growing trend where investors consider political risks as part of their investment strategies.

Moreover, the decline in U.S. stocks underscores the volatility present in the current market environment. Economic indicators, such as inflation rates and consumer sentiment, have been fluctuating, creating an atmosphere of caution among investors. With many stocks reaching record highs in recent months, the market appears ripe for correction, especially when compounded by external factors like political controversies. Investors are now faced with the challenge of navigating these complexities as they make decisions about their portfolios.

As we move forward, the relationship between corporate leaders and their public personas may become increasingly significant in shaping market dynamics. The Tesla-Musk-Trump situation serves as a reminder of how intertwined business and politics can be and the potential ramifications for stock performance. Investors will need to remain vigilant, keeping an eye on both market trends and the broader political landscape as they strive to manage their investments effectively. The recent pullback in U.S. stocks may signal a recalibration of expectations, urging market participants to reassess their strategies in light of evolving circumstances.