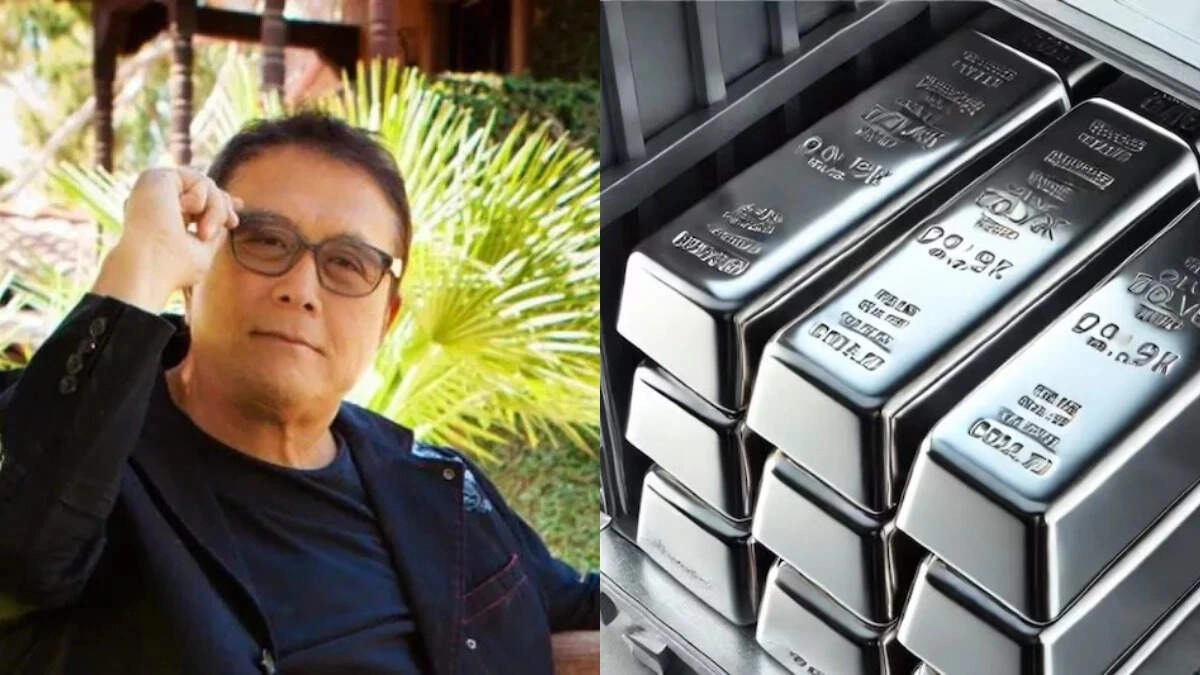

A significant alert has been issued regarding silver prices, drawing attention from both investors and market analysts. The author of the well-known book “Rich Dad Poor Dad,” Robert Kiyosaki, has made some startling comments about the current state of the silver market, referring to it as a potential “silver bubble.” His insights are particularly relevant for investors keen on understanding the fluctuations in precious metal prices and the overall economic landscape.

Kiyosaki’s warning suggests that the rapid increase in silver prices could lead to a bubble that may eventually burst, causing significant financial repercussions for those heavily invested in the metal. He emphasizes the need for investors to conduct thorough research and be cautious in their investment strategies. The author’s perspective is grounded in his broader view of economic trends, inflation, and the impact of government policies on precious metals. He urges individuals to be proactive, not just reactive, when it comes to their investments.

Investors should pay close attention to these developments and consider diversifying their portfolios to mitigate potential risks associated with a volatile market. Kiyosaki’s advice resonates in today’s economic climate, where uncertainty looms large, and traditional investment strategies may no longer yield the expected results. Engaging with expert analysis and staying informed about market trends can be crucial steps for anyone looking to navigate the complexities of investing in silver and other precious metals.